30 Jan 2025

Tools and services used

About Open Bionics

Bristol-based Open Bionics is a pioneering British prosthetics company which secured a £600,000 Intellectual Property-backed loan from NatWest to open six more clinics in the US, helping more patients to access its life-changing Hero Arm.

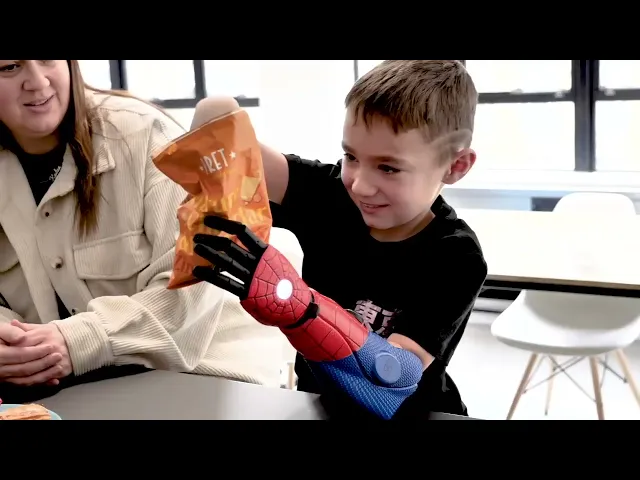

Open Bionics harnesses cutting-edge 3D printing and scanning technology to design and build affordable, custom-built bionic arms for children as young as five and adults who are missing hands due to birth differences, accidents, injuries, or illnesses. Designed for individuals with below-elbow limb differences, the Hero Arm uses advanced myoelectric sensors to detect muscle contractions in the arm. These signals are amplified and transformed into intuitive, proportional hand movements, enabling users to grab, pinch, high-five, fist bump, and give a thumbs-up with ease and confidence.

Through innovative licensing deals with companies such as DC and Marvel, they have been able to create superhero themed arms which reduce the stigma of prosthetics for school children.

The Challenge

Open Bionics was looking for funding to help drive its expansion in the US; it set up a number of clinics in 2023, but there was an obvious opportunity and huge market demand for more.

The Solution

The NatWest High Growth IP-backed loan was launched in January 2024 in partnership with IP evaluation experts Inngot. Loans for IP-rich scaleup SMEs start from as low as £250,000 and go up to £10m. Loans are secured against up to 50% of the value of the firm’s qualifying intangible assets, as determined by Inngot’s sophisticated IP identification and valuation toolkit. The IP-backed loan targets growth companies which are rich in intangible assets, but have few tangible assets, making it difficult or even impossible for them to get traditional lending from banks. Software, patents, copyrights, trademarks, registered designs and other intangibles can be valued and used as collateral.

We’re really excited to use this funding to supercharge growth in the USA and make it much easier for our patients to access specialist care within their state by visiting their Open Bionics clinic.

Samantha Payne MBE - Co-founder and CEO (USA)

Open Bionics was looking for a funder to fuel an important growth phase. NatWest and Inngot stepped in to support us through our scale up journey via a novel IP-based lending agreement. We are very excited by the growth enabled by this investment.

Taylor Purkis - CFO

The Result

£600,000 IP loan approved by NatWest

Open Bionics successfully negotiated a £600,000 finance package from NatWest using its IP as collateral, and will be using the funding to open another six clinics across the US to help more patients access its innovative prosthetic limbs.

We’re proud to support Open Bionics with the financing needed to expand its business overseas, enabling more children and adults to benefit from bespoke 3D printed prosthetic arms. It can often be challenging for scale-ups to access growth capital as often they don’t have fixed assets they need to secure lending. This financing solution bridges that gap by enabling scale-ups like Open Bionics to use their intangible assets – such as patents, copyright and trade marks – to secure lending. It has been estimated that IP intensive industries generate over a quarter of the UK’s output, equivalent to around £300 billion a year, so this type of finance can make a real difference to the UK economy.

Louis Spencer - NatWest Relationship Director