Alibaba’s auction site launches ‘Intangio’ patent price guidance, harnessing new Inngot API

31 Aug 2021

Inngot has worked with our partners, international IP services business Rouse, and Chinese e-commerce and online services giant Alibaba to develop and deliver Intangio, a new tool to help Chinese insolvency practitioners set an intelligent, data-driven reserve price for patents sold on the auction platform operated by Alibaba’s Taobao subsidiary.

Alibaba’s Ali Auctions platform allows the online sale of assets, including both physical property and IP and other intangible assets, from Chinese companies which are no longer trading. Since the launch of the patent auction service in 2017, listing volumes and bidder interest have been growing strongly; however, not all lots attract the attention they may deserve.

The new Intangio tool was created to support insolvency practitioners by improving their prospects of selling patents successfully. It helps them start the auction process at an appropriate reserve price calculated by sophisticated data analysis. This addresses the issue, identified by Inngot’s research, that failure of lots to sell when first listed is often attributable to unrealistic price expectations for the patents concerned.

Intangio is a two-stage process. Insolvency practitioners can first conduct a free check on an individual patent to determine whether it is likely to be of significant value. They then have the option to buy a detailed report that can be shared with prospective purchasers (either for an individual patent, or for a lot of up to 10).

The first release of the Intangio API investigates two aspects – the intrinsic quality of the patents themselves, and the level of market interest in, and appetite for, patents in the field of technology to which they relate. This is driven by detailed analysis of historical Chinese sales of distressed assets at auction. It also incorporates data from local and international patent databases, and from Rouse’s CIELA database of Chinese IP administrative appeals and civil infringement proceedings.

Martin Brassell, co-founder and CEO of Inngot (pictured above), says:

“The growing number of patent auction listings prompted Alibaba to investigate ways of providing trustworthy estimates of likely value at scale to support its users. In such a dynamic and fast-growing environment, this can only be done using a data-driven approach. The insights gained from historical sales and bidder behaviour, combined with intelligent analysis of the assets themselves, have enabled us to build an API which will help insolvency practitioners set a more appropriate base value for every lot they sell”.

Chris Bailey, a Principal at Rouse, says:

“Inngot is uniquely placed to provide this patent valuation solution to Ali Auctions, and we are very excited to be part of this collaboration. Intangio will play an important role in the emerging IP finance ecosystem in China, providing real assessments of disposal value that banks and insurers are looking for. Beyond the bankruptcy context, Intangio’s growing database of IP transactions and IP quality assessment methodologies can help operating companies discover more financial value in their IP.”

When the patent listing service was first introduced in 2017, nearly all listings were accompanied by a valuation. As the number of listings has rapidly grown, the proportion of lots with valuations attached has fallen substantially. Inngot’s analysis identified that the valuations applied to many of the unsold lots were simply too high to encourage bidder interest – indicating that these ‘traditional’ approaches were failing to recognize the special circumstances applicable to distressed sales of IP.

Martin Brassell adds:

“Our new API for Alibaba aligns precisely with the work we are doing to build new tools that zero in on recoverable IP value. It builds a ‘virtuous circle’ of data intelligence that can be harnessed to facilitate other forms of IP value realisation, including its use collateral for lending.

“This is part of our drive to transform IP valuation. Currently it is often regarded as an art; Inngot is turning it into a science through the use of data analytics. This is the only way IP value can be exploited at scale, and third parties can have confidence in it.

“Our work with Alibaba clearly shows that good IP assets can achieve good values, even in distress. Identifying which assets have these qualities is key to generating a sufficient degree of confidence in the recoverable value of IP to be able to underwrite and insure it.”

Inngot’s existing platform and valuation tools have already been used to support a range of lenders – general and specialist – with cashflow lending.

The new API created for the Intangio service is part of a new platform Inngot is building which will identify insurable value for IP and intangible assets. Inngot recently raised £1m in debt and equity to fund this development work.

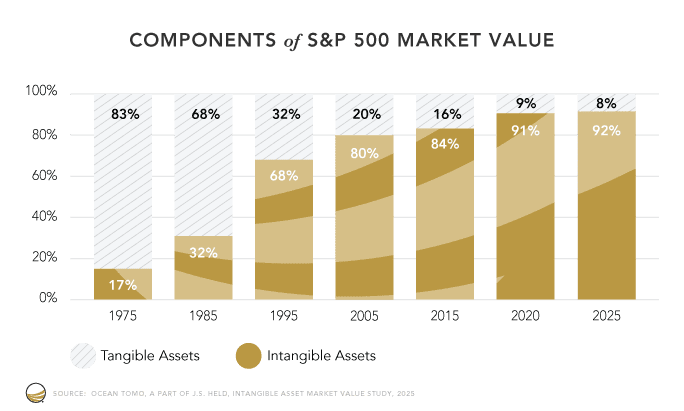

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually as a result of the pandemic in the UK alone.

Inngot has worked with our partners, international IP services business Rouse, and Chinese e-commerce and online services giant Alibaba to develop and deliver Intangio, a new tool to help Chinese insolvency practitioners set an intelligent, data-driven reserve price for patents sold on the auction platform operated by Alibaba’s Taobao subsidiary.

Alibaba’s Ali Auctions platform allows the online sale of assets, including both physical property and IP and other intangible assets, from Chinese companies which are no longer trading. Since the launch of the patent auction service in 2017, listing volumes and bidder interest have been growing strongly; however, not all lots attract the attention they may deserve.

The new Intangio tool was created to support insolvency practitioners by improving their prospects of selling patents successfully. It helps them start the auction process at an appropriate reserve price calculated by sophisticated data analysis. This addresses the issue, identified by Inngot’s research, that failure of lots to sell when first listed is often attributable to unrealistic price expectations for the patents concerned.

Intangio is a two-stage process. Insolvency practitioners can first conduct a free check on an individual patent to determine whether it is likely to be of significant value. They then have the option to buy a detailed report that can be shared with prospective purchasers (either for an individual patent, or for a lot of up to 10).

The first release of the Intangio API investigates two aspects – the intrinsic quality of the patents themselves, and the level of market interest in, and appetite for, patents in the field of technology to which they relate. This is driven by detailed analysis of historical Chinese sales of distressed assets at auction. It also incorporates data from local and international patent databases, and from Rouse’s CIELA database of Chinese IP administrative appeals and civil infringement proceedings.

Martin Brassell, co-founder and CEO of Inngot (pictured above), says:

“The growing number of patent auction listings prompted Alibaba to investigate ways of providing trustworthy estimates of likely value at scale to support its users. In such a dynamic and fast-growing environment, this can only be done using a data-driven approach. The insights gained from historical sales and bidder behaviour, combined with intelligent analysis of the assets themselves, have enabled us to build an API which will help insolvency practitioners set a more appropriate base value for every lot they sell”.

Chris Bailey, a Principal at Rouse, says:

“Inngot is uniquely placed to provide this patent valuation solution to Ali Auctions, and we are very excited to be part of this collaboration. Intangio will play an important role in the emerging IP finance ecosystem in China, providing real assessments of disposal value that banks and insurers are looking for. Beyond the bankruptcy context, Intangio’s growing database of IP transactions and IP quality assessment methodologies can help operating companies discover more financial value in their IP.”

When the patent listing service was first introduced in 2017, nearly all listings were accompanied by a valuation. As the number of listings has rapidly grown, the proportion of lots with valuations attached has fallen substantially. Inngot’s analysis identified that the valuations applied to many of the unsold lots were simply too high to encourage bidder interest – indicating that these ‘traditional’ approaches were failing to recognize the special circumstances applicable to distressed sales of IP.

Martin Brassell adds:

“Our new API for Alibaba aligns precisely with the work we are doing to build new tools that zero in on recoverable IP value. It builds a ‘virtuous circle’ of data intelligence that can be harnessed to facilitate other forms of IP value realisation, including its use collateral for lending.

“This is part of our drive to transform IP valuation. Currently it is often regarded as an art; Inngot is turning it into a science through the use of data analytics. This is the only way IP value can be exploited at scale, and third parties can have confidence in it.

“Our work with Alibaba clearly shows that good IP assets can achieve good values, even in distress. Identifying which assets have these qualities is key to generating a sufficient degree of confidence in the recoverable value of IP to be able to underwrite and insure it.”

Inngot’s existing platform and valuation tools have already been used to support a range of lenders – general and specialist – with cashflow lending.

The new API created for the Intangio service is part of a new platform Inngot is building which will identify insurable value for IP and intangible assets. Inngot recently raised £1m in debt and equity to fund this development work.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually as a result of the pandemic in the UK alone.

Inngot has worked with our partners, international IP services business Rouse, and Chinese e-commerce and online services giant Alibaba to develop and deliver Intangio, a new tool to help Chinese insolvency practitioners set an intelligent, data-driven reserve price for patents sold on the auction platform operated by Alibaba’s Taobao subsidiary.

Alibaba’s Ali Auctions platform allows the online sale of assets, including both physical property and IP and other intangible assets, from Chinese companies which are no longer trading. Since the launch of the patent auction service in 2017, listing volumes and bidder interest have been growing strongly; however, not all lots attract the attention they may deserve.

The new Intangio tool was created to support insolvency practitioners by improving their prospects of selling patents successfully. It helps them start the auction process at an appropriate reserve price calculated by sophisticated data analysis. This addresses the issue, identified by Inngot’s research, that failure of lots to sell when first listed is often attributable to unrealistic price expectations for the patents concerned.

Intangio is a two-stage process. Insolvency practitioners can first conduct a free check on an individual patent to determine whether it is likely to be of significant value. They then have the option to buy a detailed report that can be shared with prospective purchasers (either for an individual patent, or for a lot of up to 10).

The first release of the Intangio API investigates two aspects – the intrinsic quality of the patents themselves, and the level of market interest in, and appetite for, patents in the field of technology to which they relate. This is driven by detailed analysis of historical Chinese sales of distressed assets at auction. It also incorporates data from local and international patent databases, and from Rouse’s CIELA database of Chinese IP administrative appeals and civil infringement proceedings.

Martin Brassell, co-founder and CEO of Inngot (pictured above), says:

“The growing number of patent auction listings prompted Alibaba to investigate ways of providing trustworthy estimates of likely value at scale to support its users. In such a dynamic and fast-growing environment, this can only be done using a data-driven approach. The insights gained from historical sales and bidder behaviour, combined with intelligent analysis of the assets themselves, have enabled us to build an API which will help insolvency practitioners set a more appropriate base value for every lot they sell”.

Chris Bailey, a Principal at Rouse, says:

“Inngot is uniquely placed to provide this patent valuation solution to Ali Auctions, and we are very excited to be part of this collaboration. Intangio will play an important role in the emerging IP finance ecosystem in China, providing real assessments of disposal value that banks and insurers are looking for. Beyond the bankruptcy context, Intangio’s growing database of IP transactions and IP quality assessment methodologies can help operating companies discover more financial value in their IP.”

When the patent listing service was first introduced in 2017, nearly all listings were accompanied by a valuation. As the number of listings has rapidly grown, the proportion of lots with valuations attached has fallen substantially. Inngot’s analysis identified that the valuations applied to many of the unsold lots were simply too high to encourage bidder interest – indicating that these ‘traditional’ approaches were failing to recognize the special circumstances applicable to distressed sales of IP.

Martin Brassell adds:

“Our new API for Alibaba aligns precisely with the work we are doing to build new tools that zero in on recoverable IP value. It builds a ‘virtuous circle’ of data intelligence that can be harnessed to facilitate other forms of IP value realisation, including its use collateral for lending.

“This is part of our drive to transform IP valuation. Currently it is often regarded as an art; Inngot is turning it into a science through the use of data analytics. This is the only way IP value can be exploited at scale, and third parties can have confidence in it.

“Our work with Alibaba clearly shows that good IP assets can achieve good values, even in distress. Identifying which assets have these qualities is key to generating a sufficient degree of confidence in the recoverable value of IP to be able to underwrite and insure it.”

Inngot’s existing platform and valuation tools have already been used to support a range of lenders – general and specialist – with cashflow lending.

The new API created for the Intangio service is part of a new platform Inngot is building which will identify insurable value for IP and intangible assets. Inngot recently raised £1m in debt and equity to fund this development work.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually as a result of the pandemic in the UK alone.

Inngot has worked with our partners, international IP services business Rouse, and Chinese e-commerce and online services giant Alibaba to develop and deliver Intangio, a new tool to help Chinese insolvency practitioners set an intelligent, data-driven reserve price for patents sold on the auction platform operated by Alibaba’s Taobao subsidiary.

Alibaba’s Ali Auctions platform allows the online sale of assets, including both physical property and IP and other intangible assets, from Chinese companies which are no longer trading. Since the launch of the patent auction service in 2017, listing volumes and bidder interest have been growing strongly; however, not all lots attract the attention they may deserve.

The new Intangio tool was created to support insolvency practitioners by improving their prospects of selling patents successfully. It helps them start the auction process at an appropriate reserve price calculated by sophisticated data analysis. This addresses the issue, identified by Inngot’s research, that failure of lots to sell when first listed is often attributable to unrealistic price expectations for the patents concerned.

Intangio is a two-stage process. Insolvency practitioners can first conduct a free check on an individual patent to determine whether it is likely to be of significant value. They then have the option to buy a detailed report that can be shared with prospective purchasers (either for an individual patent, or for a lot of up to 10).

The first release of the Intangio API investigates two aspects – the intrinsic quality of the patents themselves, and the level of market interest in, and appetite for, patents in the field of technology to which they relate. This is driven by detailed analysis of historical Chinese sales of distressed assets at auction. It also incorporates data from local and international patent databases, and from Rouse’s CIELA database of Chinese IP administrative appeals and civil infringement proceedings.

Martin Brassell, co-founder and CEO of Inngot (pictured above), says:

“The growing number of patent auction listings prompted Alibaba to investigate ways of providing trustworthy estimates of likely value at scale to support its users. In such a dynamic and fast-growing environment, this can only be done using a data-driven approach. The insights gained from historical sales and bidder behaviour, combined with intelligent analysis of the assets themselves, have enabled us to build an API which will help insolvency practitioners set a more appropriate base value for every lot they sell”.

Chris Bailey, a Principal at Rouse, says:

“Inngot is uniquely placed to provide this patent valuation solution to Ali Auctions, and we are very excited to be part of this collaboration. Intangio will play an important role in the emerging IP finance ecosystem in China, providing real assessments of disposal value that banks and insurers are looking for. Beyond the bankruptcy context, Intangio’s growing database of IP transactions and IP quality assessment methodologies can help operating companies discover more financial value in their IP.”

When the patent listing service was first introduced in 2017, nearly all listings were accompanied by a valuation. As the number of listings has rapidly grown, the proportion of lots with valuations attached has fallen substantially. Inngot’s analysis identified that the valuations applied to many of the unsold lots were simply too high to encourage bidder interest – indicating that these ‘traditional’ approaches were failing to recognize the special circumstances applicable to distressed sales of IP.

Martin Brassell adds:

“Our new API for Alibaba aligns precisely with the work we are doing to build new tools that zero in on recoverable IP value. It builds a ‘virtuous circle’ of data intelligence that can be harnessed to facilitate other forms of IP value realisation, including its use collateral for lending.

“This is part of our drive to transform IP valuation. Currently it is often regarded as an art; Inngot is turning it into a science through the use of data analytics. This is the only way IP value can be exploited at scale, and third parties can have confidence in it.

“Our work with Alibaba clearly shows that good IP assets can achieve good values, even in distress. Identifying which assets have these qualities is key to generating a sufficient degree of confidence in the recoverable value of IP to be able to underwrite and insure it.”

Inngot’s existing platform and valuation tools have already been used to support a range of lenders – general and specialist – with cashflow lending.

The new API created for the Intangio service is part of a new platform Inngot is building which will identify insurable value for IP and intangible assets. Inngot recently raised £1m in debt and equity to fund this development work.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually as a result of the pandemic in the UK alone.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.