Inngot and HSBC value IP belong to British Corner Shop

18 Jun 2019

Bristol-based e-commerce company, British Corner Shop, which delivers British food and drink brands to British food lovers has secured a £2.73 million finance facility from HSBC UK to help meet demand from customers. As part of the loan process, Inngot and HSBC valued BCS IP using Inngot's innovative suite of online IP tools.

BCS, which stocks more than 10,000 products on its online grocery store, is using the funding from HSBC UK to support the growth of its export activities, helping it trade faster and fulfil bigger orders for both its retail and wholesale businesses.

In addition, the funding is being used to

help the company recruit three members of staff in the next two months. Part of

the finance package will also refinance existing debt facilities and help to consolidate

British Corner Shop’s banking requirements with HSBC UK.

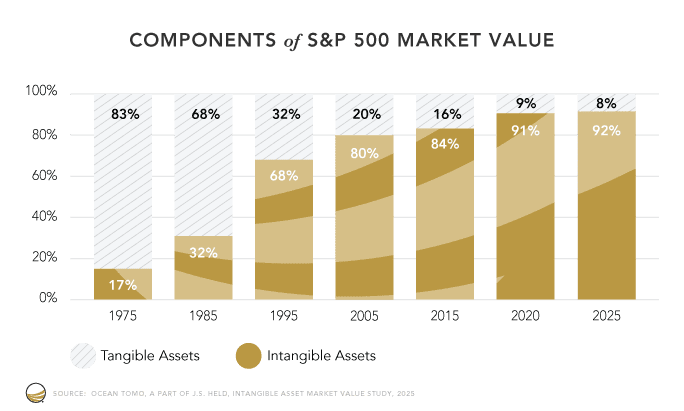

The funding was facilitated by HSBC UK’s new intellectual property (IP) lending product, which enabled the bank to understand the hidden value of the company’s IP. The product has been developed to help IP-rich technology businesses that rely on these intangible assets to break down the barriers to accessing and securing bank funding.

As part of the credit work with HSBC UK, BCS needed to affirm the value of its all-important IP and intangible assets. The bank introduced BCS to Inngot, and BCS was able to use Inngot's innovative online valuation tool, Sollomon, to quickly and easily identify and value its assets.

Inngot and HSBC have worked on other IP-Backed lending projects, including one involving rail management software company EAMS. In March 2019, within a few months of having its IP valued and securing a loan from HSBC, EAMS was acquired by Netherlands-based global asset management company Arcadis.

Andrea Tiwana, Director of UK Technology Sector at HSBC UK, explains: "Historically, lending against a company’s IP has been challenging, but as more and more tech-enabled businesses require funding, we’ve put measures in place to overcome these challenges. In addition to this, IP rich tech businesses are typically stronger through the economic cycle and can grow faster than businesses without IP, so proving and valuing their IP helps strengthen their case when applying for funding.”

Mark Callaghan, Founder of British Corner Shop, says: “Moving our banking over to HSBC UK and

securing an uplift in investment means we’re able to grow the business faster

as demand for our retail and wholesale products increases. The banking team,

led by our relationship director Mike Bobroff, helpfully talked us through the

barriers to securing funding based on our IP and found a solution that gave us

currency and them the confidence to lend. With their ongoing support, we’re

able to reach more international markets, whilst giving UK food and drink

suppliers a platform to sell their products overseas.”

British Corner Shop, which stocks brands including McVitie's, Warburtons, Robinsons, Twining’s and Branston, allows British food lovers to order their favourite British products online from their ecommerce platform which currently ships products to 196 countries across the world.

The £15 million turnover business has recently partnered with the UK’s Department for International Trade (DIT) to offer an export platform to UK food and drink suppliers, helping it increase turnover to £50 million in the next three years.

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. In addition to its IP valuation tools, it contributes to the international debate on how best to help SMEs in particular uncover and leverage the value locked up in their IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Bristol-based e-commerce company, British Corner Shop, which delivers British food and drink brands to British food lovers has secured a £2.73 million finance facility from HSBC UK to help meet demand from customers. As part of the loan process, Inngot and HSBC valued BCS IP using Inngot's innovative suite of online IP tools.

BCS, which stocks more than 10,000 products on its online grocery store, is using the funding from HSBC UK to support the growth of its export activities, helping it trade faster and fulfil bigger orders for both its retail and wholesale businesses.

In addition, the funding is being used to

help the company recruit three members of staff in the next two months. Part of

the finance package will also refinance existing debt facilities and help to consolidate

British Corner Shop’s banking requirements with HSBC UK.

The funding was facilitated by HSBC UK’s new intellectual property (IP) lending product, which enabled the bank to understand the hidden value of the company’s IP. The product has been developed to help IP-rich technology businesses that rely on these intangible assets to break down the barriers to accessing and securing bank funding.

As part of the credit work with HSBC UK, BCS needed to affirm the value of its all-important IP and intangible assets. The bank introduced BCS to Inngot, and BCS was able to use Inngot's innovative online valuation tool, Sollomon, to quickly and easily identify and value its assets.

Inngot and HSBC have worked on other IP-Backed lending projects, including one involving rail management software company EAMS. In March 2019, within a few months of having its IP valued and securing a loan from HSBC, EAMS was acquired by Netherlands-based global asset management company Arcadis.

Andrea Tiwana, Director of UK Technology Sector at HSBC UK, explains: "Historically, lending against a company’s IP has been challenging, but as more and more tech-enabled businesses require funding, we’ve put measures in place to overcome these challenges. In addition to this, IP rich tech businesses are typically stronger through the economic cycle and can grow faster than businesses without IP, so proving and valuing their IP helps strengthen their case when applying for funding.”

Mark Callaghan, Founder of British Corner Shop, says: “Moving our banking over to HSBC UK and

securing an uplift in investment means we’re able to grow the business faster

as demand for our retail and wholesale products increases. The banking team,

led by our relationship director Mike Bobroff, helpfully talked us through the

barriers to securing funding based on our IP and found a solution that gave us

currency and them the confidence to lend. With their ongoing support, we’re

able to reach more international markets, whilst giving UK food and drink

suppliers a platform to sell their products overseas.”

British Corner Shop, which stocks brands including McVitie's, Warburtons, Robinsons, Twining’s and Branston, allows British food lovers to order their favourite British products online from their ecommerce platform which currently ships products to 196 countries across the world.

The £15 million turnover business has recently partnered with the UK’s Department for International Trade (DIT) to offer an export platform to UK food and drink suppliers, helping it increase turnover to £50 million in the next three years.

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. In addition to its IP valuation tools, it contributes to the international debate on how best to help SMEs in particular uncover and leverage the value locked up in their IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Bristol-based e-commerce company, British Corner Shop, which delivers British food and drink brands to British food lovers has secured a £2.73 million finance facility from HSBC UK to help meet demand from customers. As part of the loan process, Inngot and HSBC valued BCS IP using Inngot's innovative suite of online IP tools.

BCS, which stocks more than 10,000 products on its online grocery store, is using the funding from HSBC UK to support the growth of its export activities, helping it trade faster and fulfil bigger orders for both its retail and wholesale businesses.

In addition, the funding is being used to

help the company recruit three members of staff in the next two months. Part of

the finance package will also refinance existing debt facilities and help to consolidate

British Corner Shop’s banking requirements with HSBC UK.

The funding was facilitated by HSBC UK’s new intellectual property (IP) lending product, which enabled the bank to understand the hidden value of the company’s IP. The product has been developed to help IP-rich technology businesses that rely on these intangible assets to break down the barriers to accessing and securing bank funding.

As part of the credit work with HSBC UK, BCS needed to affirm the value of its all-important IP and intangible assets. The bank introduced BCS to Inngot, and BCS was able to use Inngot's innovative online valuation tool, Sollomon, to quickly and easily identify and value its assets.

Inngot and HSBC have worked on other IP-Backed lending projects, including one involving rail management software company EAMS. In March 2019, within a few months of having its IP valued and securing a loan from HSBC, EAMS was acquired by Netherlands-based global asset management company Arcadis.

Andrea Tiwana, Director of UK Technology Sector at HSBC UK, explains: "Historically, lending against a company’s IP has been challenging, but as more and more tech-enabled businesses require funding, we’ve put measures in place to overcome these challenges. In addition to this, IP rich tech businesses are typically stronger through the economic cycle and can grow faster than businesses without IP, so proving and valuing their IP helps strengthen their case when applying for funding.”

Mark Callaghan, Founder of British Corner Shop, says: “Moving our banking over to HSBC UK and

securing an uplift in investment means we’re able to grow the business faster

as demand for our retail and wholesale products increases. The banking team,

led by our relationship director Mike Bobroff, helpfully talked us through the

barriers to securing funding based on our IP and found a solution that gave us

currency and them the confidence to lend. With their ongoing support, we’re

able to reach more international markets, whilst giving UK food and drink

suppliers a platform to sell their products overseas.”

British Corner Shop, which stocks brands including McVitie's, Warburtons, Robinsons, Twining’s and Branston, allows British food lovers to order their favourite British products online from their ecommerce platform which currently ships products to 196 countries across the world.

The £15 million turnover business has recently partnered with the UK’s Department for International Trade (DIT) to offer an export platform to UK food and drink suppliers, helping it increase turnover to £50 million in the next three years.

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. In addition to its IP valuation tools, it contributes to the international debate on how best to help SMEs in particular uncover and leverage the value locked up in their IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Bristol-based e-commerce company, British Corner Shop, which delivers British food and drink brands to British food lovers has secured a £2.73 million finance facility from HSBC UK to help meet demand from customers. As part of the loan process, Inngot and HSBC valued BCS IP using Inngot's innovative suite of online IP tools.

BCS, which stocks more than 10,000 products on its online grocery store, is using the funding from HSBC UK to support the growth of its export activities, helping it trade faster and fulfil bigger orders for both its retail and wholesale businesses.

In addition, the funding is being used to

help the company recruit three members of staff in the next two months. Part of

the finance package will also refinance existing debt facilities and help to consolidate

British Corner Shop’s banking requirements with HSBC UK.

The funding was facilitated by HSBC UK’s new intellectual property (IP) lending product, which enabled the bank to understand the hidden value of the company’s IP. The product has been developed to help IP-rich technology businesses that rely on these intangible assets to break down the barriers to accessing and securing bank funding.

As part of the credit work with HSBC UK, BCS needed to affirm the value of its all-important IP and intangible assets. The bank introduced BCS to Inngot, and BCS was able to use Inngot's innovative online valuation tool, Sollomon, to quickly and easily identify and value its assets.

Inngot and HSBC have worked on other IP-Backed lending projects, including one involving rail management software company EAMS. In March 2019, within a few months of having its IP valued and securing a loan from HSBC, EAMS was acquired by Netherlands-based global asset management company Arcadis.

Andrea Tiwana, Director of UK Technology Sector at HSBC UK, explains: "Historically, lending against a company’s IP has been challenging, but as more and more tech-enabled businesses require funding, we’ve put measures in place to overcome these challenges. In addition to this, IP rich tech businesses are typically stronger through the economic cycle and can grow faster than businesses without IP, so proving and valuing their IP helps strengthen their case when applying for funding.”

Mark Callaghan, Founder of British Corner Shop, says: “Moving our banking over to HSBC UK and

securing an uplift in investment means we’re able to grow the business faster

as demand for our retail and wholesale products increases. The banking team,

led by our relationship director Mike Bobroff, helpfully talked us through the

barriers to securing funding based on our IP and found a solution that gave us

currency and them the confidence to lend. With their ongoing support, we’re

able to reach more international markets, whilst giving UK food and drink

suppliers a platform to sell their products overseas.”

British Corner Shop, which stocks brands including McVitie's, Warburtons, Robinsons, Twining’s and Branston, allows British food lovers to order their favourite British products online from their ecommerce platform which currently ships products to 196 countries across the world.

The £15 million turnover business has recently partnered with the UK’s Department for International Trade (DIT) to offer an export platform to UK food and drink suppliers, helping it increase turnover to £50 million in the next three years.

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. In addition to its IP valuation tools, it contributes to the international debate on how best to help SMEs in particular uncover and leverage the value locked up in their IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.