Inngot raises £1m funding to build new platform to solve the scale-up finance gap

3 Aug 2021

Inngot has successfully completed a £1m debt and equity funding round to build and launch its latest systems.

The round enables Inngot to complete and launch its new platform to enable IP’s insurable value to be identified and underwritten internationally.

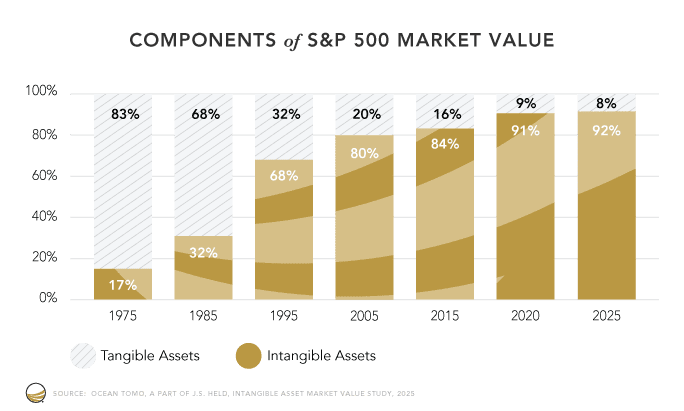

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually1 as a result of the pandemic in the UK alone.

Taking security over business assets is a well-established practice in finance. If a company gets into difficulty, lenders can recover outstanding debts by disposing of physical commodities like buildings, machinery and equipment. However, knowledge-based companies own very few of these assets, and the intangibles that drive their business models have proved hard to utilise in finance due to absence of capital relief and uncertainty over their recoverable value.

As Inngot CEO Martin Brassell (pictured above) explains, this is precisely the issue Inngot is addressing. “Financiers have difficulties utilising IP as security because it is not usually traded in a transparent manner. However, the reason for this is not because there is no value or no appetite, but because there is no supply – IP is simply too important to the companies that own it.

“The fundamental importance of IP for business growth makes it highly suitable for use as security, provided that measures can be put in place to ensure residual value can be recovered if needed. Our new platform is the ‘missing link’ that can establish what that value is and where it lies, and do it consistently and at scale.”

The debt element of the fundraise is a £436,000 Innovation Continuity Loan from Innovate UK, the UK’s innovation agency, made available under a £210m scheme to support the commercialisation of successful grant-funded projects post-Covid-19. Both the original grant and the new loan are directed at introducing scalable, data-driven methods to assess the suitability of IP and intangibles for use as loan collateral.

More than two-thirds of the equity element has been raised from Inngot’s existing shareholders. These are led by Chairman David Hulston, non-executive director Simon Thorpe (former BBAA Investor of the Year) and Hamish Williams of St Helen’s Private Equity.

The Future of Growth Capital, Innovate Finance, ScaleUp Institute, Deloitte 2020

Inngot has successfully completed a £1m debt and equity funding round to build and launch its latest systems.

The round enables Inngot to complete and launch its new platform to enable IP’s insurable value to be identified and underwritten internationally.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually1 as a result of the pandemic in the UK alone.

Taking security over business assets is a well-established practice in finance. If a company gets into difficulty, lenders can recover outstanding debts by disposing of physical commodities like buildings, machinery and equipment. However, knowledge-based companies own very few of these assets, and the intangibles that drive their business models have proved hard to utilise in finance due to absence of capital relief and uncertainty over their recoverable value.

As Inngot CEO Martin Brassell (pictured above) explains, this is precisely the issue Inngot is addressing. “Financiers have difficulties utilising IP as security because it is not usually traded in a transparent manner. However, the reason for this is not because there is no value or no appetite, but because there is no supply – IP is simply too important to the companies that own it.

“The fundamental importance of IP for business growth makes it highly suitable for use as security, provided that measures can be put in place to ensure residual value can be recovered if needed. Our new platform is the ‘missing link’ that can establish what that value is and where it lies, and do it consistently and at scale.”

The debt element of the fundraise is a £436,000 Innovation Continuity Loan from Innovate UK, the UK’s innovation agency, made available under a £210m scheme to support the commercialisation of successful grant-funded projects post-Covid-19. Both the original grant and the new loan are directed at introducing scalable, data-driven methods to assess the suitability of IP and intangibles for use as loan collateral.

More than two-thirds of the equity element has been raised from Inngot’s existing shareholders. These are led by Chairman David Hulston, non-executive director Simon Thorpe (former BBAA Investor of the Year) and Hamish Williams of St Helen’s Private Equity.

The Future of Growth Capital, Innovate Finance, ScaleUp Institute, Deloitte 2020

Inngot has successfully completed a £1m debt and equity funding round to build and launch its latest systems.

The round enables Inngot to complete and launch its new platform to enable IP’s insurable value to be identified and underwritten internationally.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually1 as a result of the pandemic in the UK alone.

Taking security over business assets is a well-established practice in finance. If a company gets into difficulty, lenders can recover outstanding debts by disposing of physical commodities like buildings, machinery and equipment. However, knowledge-based companies own very few of these assets, and the intangibles that drive their business models have proved hard to utilise in finance due to absence of capital relief and uncertainty over their recoverable value.

As Inngot CEO Martin Brassell (pictured above) explains, this is precisely the issue Inngot is addressing. “Financiers have difficulties utilising IP as security because it is not usually traded in a transparent manner. However, the reason for this is not because there is no value or no appetite, but because there is no supply – IP is simply too important to the companies that own it.

“The fundamental importance of IP for business growth makes it highly suitable for use as security, provided that measures can be put in place to ensure residual value can be recovered if needed. Our new platform is the ‘missing link’ that can establish what that value is and where it lies, and do it consistently and at scale.”

The debt element of the fundraise is a £436,000 Innovation Continuity Loan from Innovate UK, the UK’s innovation agency, made available under a £210m scheme to support the commercialisation of successful grant-funded projects post-Covid-19. Both the original grant and the new loan are directed at introducing scalable, data-driven methods to assess the suitability of IP and intangibles for use as loan collateral.

More than two-thirds of the equity element has been raised from Inngot’s existing shareholders. These are led by Chairman David Hulston, non-executive director Simon Thorpe (former BBAA Investor of the Year) and Hamish Williams of St Helen’s Private Equity.

The Future of Growth Capital, Innovate Finance, ScaleUp Institute, Deloitte 2020

Inngot has successfully completed a £1m debt and equity funding round to build and launch its latest systems.

The round enables Inngot to complete and launch its new platform to enable IP’s insurable value to be identified and underwritten internationally.

This is a crucial development for innovative, high-growth businesses, whose assets are predominantly intangible in nature. Inngot’s approach targets a scale-up funding gap recently estimated to have grown to £15bn annually1 as a result of the pandemic in the UK alone.

Taking security over business assets is a well-established practice in finance. If a company gets into difficulty, lenders can recover outstanding debts by disposing of physical commodities like buildings, machinery and equipment. However, knowledge-based companies own very few of these assets, and the intangibles that drive their business models have proved hard to utilise in finance due to absence of capital relief and uncertainty over their recoverable value.

As Inngot CEO Martin Brassell (pictured above) explains, this is precisely the issue Inngot is addressing. “Financiers have difficulties utilising IP as security because it is not usually traded in a transparent manner. However, the reason for this is not because there is no value or no appetite, but because there is no supply – IP is simply too important to the companies that own it.

“The fundamental importance of IP for business growth makes it highly suitable for use as security, provided that measures can be put in place to ensure residual value can be recovered if needed. Our new platform is the ‘missing link’ that can establish what that value is and where it lies, and do it consistently and at scale.”

The debt element of the fundraise is a £436,000 Innovation Continuity Loan from Innovate UK, the UK’s innovation agency, made available under a £210m scheme to support the commercialisation of successful grant-funded projects post-Covid-19. Both the original grant and the new loan are directed at introducing scalable, data-driven methods to assess the suitability of IP and intangibles for use as loan collateral.

More than two-thirds of the equity element has been raised from Inngot’s existing shareholders. These are led by Chairman David Hulston, non-executive director Simon Thorpe (former BBAA Investor of the Year) and Hamish Williams of St Helen’s Private Equity.

The Future of Growth Capital, Innovate Finance, ScaleUp Institute, Deloitte 2020

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.