IP as collateral article by Inngot CEO in IP Magazine

14 Apr 2019

Inngot CEO and co-founder, Martin Brassell, has written an article about moves to encourage the use of IP as collateral for the May 2019 issue of Intellectual Property Magazine.

The IP Magazine article can be accessed here (subscription or free registration required).

Entitled ‘Unlocking IP for Lending, the piece reviews various initiatives around the world aimed at helping companies – in particular SMEs – release some of the value locked up in their home-grown intellectual property and intangible assets. The article is based on a report for the OECD which Martin Brassell co-authored, published in January.

In the article, Martin Brassell, who is known around the world for his contributions to the debate on how best to allow companies access to the value locked up in their IP and intangibles, particularly by facilitating the use of IP as collateral for funding, concludes:

"Without intervention, companies with knowledge-based assets developed in-house face a “Catch 22” situation. To exploit their IP and intangibles, they need funding; but this funding is elusive, because their IP is not deemed to have any value, until and unless it is sold (at which point, it becomes apparent that there was material value in the business all the time).

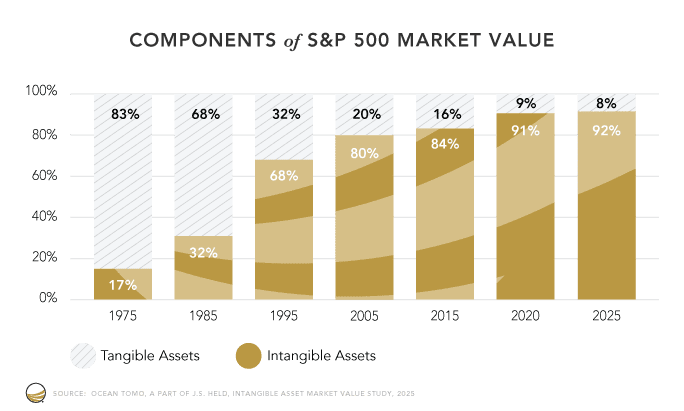

"This problem is not a new one: finding ways to enable companies to realise the value of their IP and intangibles has been on the agenda ever since the IT revolution of the 1980s. However, it is becoming much more pressing, since even the smallest of companies now has ready access to massive computing power, and there are relatively fewer tangible assets to finance."

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. It is working with major banks and lenders to encourage the use of IP as collateral. In addition to its IP valuation tools, it helps drive policy around IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Inngot CEO and co-founder, Martin Brassell, has written an article about moves to encourage the use of IP as collateral for the May 2019 issue of Intellectual Property Magazine.

The IP Magazine article can be accessed here (subscription or free registration required).

Entitled ‘Unlocking IP for Lending, the piece reviews various initiatives around the world aimed at helping companies – in particular SMEs – release some of the value locked up in their home-grown intellectual property and intangible assets. The article is based on a report for the OECD which Martin Brassell co-authored, published in January.

In the article, Martin Brassell, who is known around the world for his contributions to the debate on how best to allow companies access to the value locked up in their IP and intangibles, particularly by facilitating the use of IP as collateral for funding, concludes:

"Without intervention, companies with knowledge-based assets developed in-house face a “Catch 22” situation. To exploit their IP and intangibles, they need funding; but this funding is elusive, because their IP is not deemed to have any value, until and unless it is sold (at which point, it becomes apparent that there was material value in the business all the time).

"This problem is not a new one: finding ways to enable companies to realise the value of their IP and intangibles has been on the agenda ever since the IT revolution of the 1980s. However, it is becoming much more pressing, since even the smallest of companies now has ready access to massive computing power, and there are relatively fewer tangible assets to finance."

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. It is working with major banks and lenders to encourage the use of IP as collateral. In addition to its IP valuation tools, it helps drive policy around IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Inngot CEO and co-founder, Martin Brassell, has written an article about moves to encourage the use of IP as collateral for the May 2019 issue of Intellectual Property Magazine.

The IP Magazine article can be accessed here (subscription or free registration required).

Entitled ‘Unlocking IP for Lending, the piece reviews various initiatives around the world aimed at helping companies – in particular SMEs – release some of the value locked up in their home-grown intellectual property and intangible assets. The article is based on a report for the OECD which Martin Brassell co-authored, published in January.

In the article, Martin Brassell, who is known around the world for his contributions to the debate on how best to allow companies access to the value locked up in their IP and intangibles, particularly by facilitating the use of IP as collateral for funding, concludes:

"Without intervention, companies with knowledge-based assets developed in-house face a “Catch 22” situation. To exploit their IP and intangibles, they need funding; but this funding is elusive, because their IP is not deemed to have any value, until and unless it is sold (at which point, it becomes apparent that there was material value in the business all the time).

"This problem is not a new one: finding ways to enable companies to realise the value of their IP and intangibles has been on the agenda ever since the IT revolution of the 1980s. However, it is becoming much more pressing, since even the smallest of companies now has ready access to massive computing power, and there are relatively fewer tangible assets to finance."

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. It is working with major banks and lenders to encourage the use of IP as collateral. In addition to its IP valuation tools, it helps drive policy around IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Inngot CEO and co-founder, Martin Brassell, has written an article about moves to encourage the use of IP as collateral for the May 2019 issue of Intellectual Property Magazine.

The IP Magazine article can be accessed here (subscription or free registration required).

Entitled ‘Unlocking IP for Lending, the piece reviews various initiatives around the world aimed at helping companies – in particular SMEs – release some of the value locked up in their home-grown intellectual property and intangible assets. The article is based on a report for the OECD which Martin Brassell co-authored, published in January.

In the article, Martin Brassell, who is known around the world for his contributions to the debate on how best to allow companies access to the value locked up in their IP and intangibles, particularly by facilitating the use of IP as collateral for funding, concludes:

"Without intervention, companies with knowledge-based assets developed in-house face a “Catch 22” situation. To exploit their IP and intangibles, they need funding; but this funding is elusive, because their IP is not deemed to have any value, until and unless it is sold (at which point, it becomes apparent that there was material value in the business all the time).

"This problem is not a new one: finding ways to enable companies to realise the value of their IP and intangibles has been on the agenda ever since the IT revolution of the 1980s. However, it is becoming much more pressing, since even the smallest of companies now has ready access to massive computing power, and there are relatively fewer tangible assets to finance."

Inngot offers a suite of online tools to help innovative businesses identify, manage and value intellectual property and intangible assets. It is working with major banks and lenders to encourage the use of IP as collateral. In addition to its IP valuation tools, it helps drive policy around IP and intangible assets and offers bespoke IP valuation and technology valuation services.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.