IP Finance explained

5 Mar 2021

We've added a new IP Finance page to our website, with an explanation of what IP-based finance is and how it can be used to help discussions about equity and debt finance.

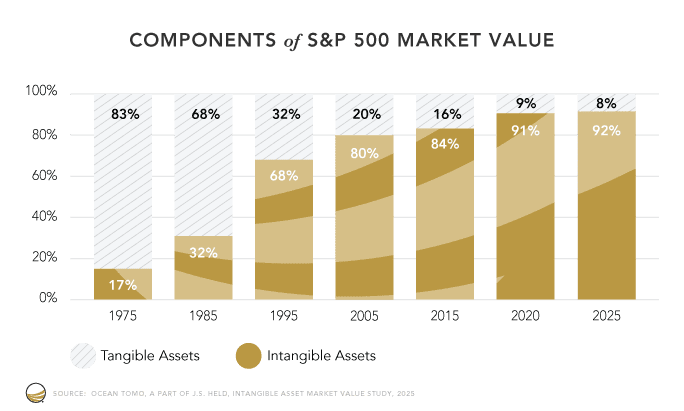

IP and intangibles are increasingly important to businesses of all sizes. Inngot has been working with lenders, business groups, governments and bodies like the OECD to find ways to make it easier and more cost-effective for businesses to have their IP accepted as collateral, so they can raise the capital they urgently need to grow and succeed.

Our innovative and ground-breaking internet tools are a key part of this effort, allowing companies, and particularly SMEs, to create a comprehensive inventory of all the IP and intangibles they own and then get an indicative valuation for them which they can literally take to the bank.

Over the coming months, we will be adding details of how companies have used IP-based finance to get the funds they need, including profiles of lenders and case studies on users.

Want to know more about how IP-based finance can help you unlock the value of your IP and intangible assets? Contact us by email at Info@inngot.com.

We've added a new IP Finance page to our website, with an explanation of what IP-based finance is and how it can be used to help discussions about equity and debt finance.

IP and intangibles are increasingly important to businesses of all sizes. Inngot has been working with lenders, business groups, governments and bodies like the OECD to find ways to make it easier and more cost-effective for businesses to have their IP accepted as collateral, so they can raise the capital they urgently need to grow and succeed.

Our innovative and ground-breaking internet tools are a key part of this effort, allowing companies, and particularly SMEs, to create a comprehensive inventory of all the IP and intangibles they own and then get an indicative valuation for them which they can literally take to the bank.

Over the coming months, we will be adding details of how companies have used IP-based finance to get the funds they need, including profiles of lenders and case studies on users.

Want to know more about how IP-based finance can help you unlock the value of your IP and intangible assets? Contact us by email at Info@inngot.com.

We've added a new IP Finance page to our website, with an explanation of what IP-based finance is and how it can be used to help discussions about equity and debt finance.

IP and intangibles are increasingly important to businesses of all sizes. Inngot has been working with lenders, business groups, governments and bodies like the OECD to find ways to make it easier and more cost-effective for businesses to have their IP accepted as collateral, so they can raise the capital they urgently need to grow and succeed.

Our innovative and ground-breaking internet tools are a key part of this effort, allowing companies, and particularly SMEs, to create a comprehensive inventory of all the IP and intangibles they own and then get an indicative valuation for them which they can literally take to the bank.

Over the coming months, we will be adding details of how companies have used IP-based finance to get the funds they need, including profiles of lenders and case studies on users.

Want to know more about how IP-based finance can help you unlock the value of your IP and intangible assets? Contact us by email at Info@inngot.com.

We've added a new IP Finance page to our website, with an explanation of what IP-based finance is and how it can be used to help discussions about equity and debt finance.

IP and intangibles are increasingly important to businesses of all sizes. Inngot has been working with lenders, business groups, governments and bodies like the OECD to find ways to make it easier and more cost-effective for businesses to have their IP accepted as collateral, so they can raise the capital they urgently need to grow and succeed.

Our innovative and ground-breaking internet tools are a key part of this effort, allowing companies, and particularly SMEs, to create a comprehensive inventory of all the IP and intangibles they own and then get an indicative valuation for them which they can literally take to the bank.

Over the coming months, we will be adding details of how companies have used IP-based finance to get the funds they need, including profiles of lenders and case studies on users.

Want to know more about how IP-based finance can help you unlock the value of your IP and intangible assets? Contact us by email at Info@inngot.com.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.