Labour Start-up, Scale-up review aims to tackle £16bn UK growth firm funding gap

19 Dec 2022

Rachel Reeves, Shadow Chancellor, has revealed plans to shake-up funding for start-up and scale-up companies if the Labour Party wins the next General Election.

The proposals have been drawn up as part of the Start-up, Scale-up review of SME funding, tasked with delivering against Labour’s ambition to “make Britain the best place to start and grow a business.” The key recommendations of the review panel were announced to an audience of 350 business leaders at the Labour Party’s Business Conference on December 8th 2022.

Reeves said the recommendations are the first step in closing a £16bn investment gap for high-growth firms that the UK is missing out on, and they will be used to inform Labour’s next manifesto.

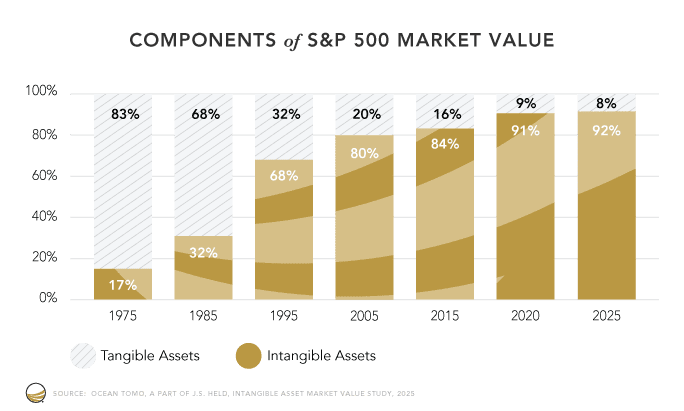

Martin Brassell, CEO of Inngot says: “We were delighted to see that the Start-up, Scale-up report has recognised the challenges faced by IP-rich but tangible asset-poor start-ups and scale-ups – as it says, banks have traditionally been reluctant to secure debt funding against IP. That attitude, however, is changing, and we are working with some of the more forward-thinking banks to help them assess IP value for lending purposes.”

The key recommendations of the review are:

Unlocking institutional investment and patient capital by: building engagement between institutional investors and VCs; freeing ISA investors to invest in high-growth firms; making pension fund investments more effective though fund consolidation; and allowing institutional investors to invest alongside the British Business Bank (BBB).

Transforming the British Business Bank: the BBB needs to be allowed more independence, given a wider remit and the ability to leverage external funds to amplify its work. The BBB should support the creation of clusters involving groups of universities to drive growth and investment across the whole of the UK.

Translating world-leading research into growth: Encourage entrepreneurialism and spinouts based on university research by creating a dashboard summarising each university’s offer to spinouts, and metrics of each university’s spinout success. The panel also recommended that universities offer a wider range of options for spinout founders to choose from, including one where the university takes a relatively small equity stake.

Making public procurement work for start-ups: Labour should create a Procurement Council of Experts to review best practice in public sector procurement, with a view to allowing start-ups to better compete for public contracts.

Incentivising investment and entrepreneurship: Labour should maintain and build on existing incentives, such as SEIS, EIS and the R&D tax credit system, to ensure investors and firms have the best possible incentives for growth.

The panel invited submissions from a wide range of companies, financial institutions, academic bodies and investors. Inngot provided comments on the potential benefits of the UK’s supporting the availability of IP-based finance (where companies can use their IP as collateral for loans).

The report acknowledges concerns over the “limited debt funding options for growing companies. Historically lenders have relied on tangible asset security when lending to smaller companies. On top of the issues this can create… as the economic landscape shifts towards knowledge-led firms, it was pointed out that firms may have less in the way of tangible assets to secure loans. Roundtable participants pointed out that banks are highly reluctant to secure debt funding against IP.”

The report also said submissions “highlighted that alternate lenders to small and start-up businesses still struggled to access wholesale capital, and that improving this could in turn help drive SME lending growth.”

The review panel was headed by former Chief Economist of Goldman Sachs Lord Jim O’Neill, now a cross-bench peer and non-exec chairman of investment body Northern Gritstone. It also included tech entrepreneur Tom Adeyoola; Alex Depledge, CEO and co-founder of Resi.co.uk, the UK’s largest home improvement platform; and Julie Devonshire, the Director of the Entrepreneurship Institute at King’s College London.

Rachel Reeves, Shadow Chancellor, has revealed plans to shake-up funding for start-up and scale-up companies if the Labour Party wins the next General Election.

The proposals have been drawn up as part of the Start-up, Scale-up review of SME funding, tasked with delivering against Labour’s ambition to “make Britain the best place to start and grow a business.” The key recommendations of the review panel were announced to an audience of 350 business leaders at the Labour Party’s Business Conference on December 8th 2022.

Reeves said the recommendations are the first step in closing a £16bn investment gap for high-growth firms that the UK is missing out on, and they will be used to inform Labour’s next manifesto.

Martin Brassell, CEO of Inngot says: “We were delighted to see that the Start-up, Scale-up report has recognised the challenges faced by IP-rich but tangible asset-poor start-ups and scale-ups – as it says, banks have traditionally been reluctant to secure debt funding against IP. That attitude, however, is changing, and we are working with some of the more forward-thinking banks to help them assess IP value for lending purposes.”

The key recommendations of the review are:

Unlocking institutional investment and patient capital by: building engagement between institutional investors and VCs; freeing ISA investors to invest in high-growth firms; making pension fund investments more effective though fund consolidation; and allowing institutional investors to invest alongside the British Business Bank (BBB).

Transforming the British Business Bank: the BBB needs to be allowed more independence, given a wider remit and the ability to leverage external funds to amplify its work. The BBB should support the creation of clusters involving groups of universities to drive growth and investment across the whole of the UK.

Translating world-leading research into growth: Encourage entrepreneurialism and spinouts based on university research by creating a dashboard summarising each university’s offer to spinouts, and metrics of each university’s spinout success. The panel also recommended that universities offer a wider range of options for spinout founders to choose from, including one where the university takes a relatively small equity stake.

Making public procurement work for start-ups: Labour should create a Procurement Council of Experts to review best practice in public sector procurement, with a view to allowing start-ups to better compete for public contracts.

Incentivising investment and entrepreneurship: Labour should maintain and build on existing incentives, such as SEIS, EIS and the R&D tax credit system, to ensure investors and firms have the best possible incentives for growth.

The panel invited submissions from a wide range of companies, financial institutions, academic bodies and investors. Inngot provided comments on the potential benefits of the UK’s supporting the availability of IP-based finance (where companies can use their IP as collateral for loans).

The report acknowledges concerns over the “limited debt funding options for growing companies. Historically lenders have relied on tangible asset security when lending to smaller companies. On top of the issues this can create… as the economic landscape shifts towards knowledge-led firms, it was pointed out that firms may have less in the way of tangible assets to secure loans. Roundtable participants pointed out that banks are highly reluctant to secure debt funding against IP.”

The report also said submissions “highlighted that alternate lenders to small and start-up businesses still struggled to access wholesale capital, and that improving this could in turn help drive SME lending growth.”

The review panel was headed by former Chief Economist of Goldman Sachs Lord Jim O’Neill, now a cross-bench peer and non-exec chairman of investment body Northern Gritstone. It also included tech entrepreneur Tom Adeyoola; Alex Depledge, CEO and co-founder of Resi.co.uk, the UK’s largest home improvement platform; and Julie Devonshire, the Director of the Entrepreneurship Institute at King’s College London.

Rachel Reeves, Shadow Chancellor, has revealed plans to shake-up funding for start-up and scale-up companies if the Labour Party wins the next General Election.

The proposals have been drawn up as part of the Start-up, Scale-up review of SME funding, tasked with delivering against Labour’s ambition to “make Britain the best place to start and grow a business.” The key recommendations of the review panel were announced to an audience of 350 business leaders at the Labour Party’s Business Conference on December 8th 2022.

Reeves said the recommendations are the first step in closing a £16bn investment gap for high-growth firms that the UK is missing out on, and they will be used to inform Labour’s next manifesto.

Martin Brassell, CEO of Inngot says: “We were delighted to see that the Start-up, Scale-up report has recognised the challenges faced by IP-rich but tangible asset-poor start-ups and scale-ups – as it says, banks have traditionally been reluctant to secure debt funding against IP. That attitude, however, is changing, and we are working with some of the more forward-thinking banks to help them assess IP value for lending purposes.”

The key recommendations of the review are:

Unlocking institutional investment and patient capital by: building engagement between institutional investors and VCs; freeing ISA investors to invest in high-growth firms; making pension fund investments more effective though fund consolidation; and allowing institutional investors to invest alongside the British Business Bank (BBB).

Transforming the British Business Bank: the BBB needs to be allowed more independence, given a wider remit and the ability to leverage external funds to amplify its work. The BBB should support the creation of clusters involving groups of universities to drive growth and investment across the whole of the UK.

Translating world-leading research into growth: Encourage entrepreneurialism and spinouts based on university research by creating a dashboard summarising each university’s offer to spinouts, and metrics of each university’s spinout success. The panel also recommended that universities offer a wider range of options for spinout founders to choose from, including one where the university takes a relatively small equity stake.

Making public procurement work for start-ups: Labour should create a Procurement Council of Experts to review best practice in public sector procurement, with a view to allowing start-ups to better compete for public contracts.

Incentivising investment and entrepreneurship: Labour should maintain and build on existing incentives, such as SEIS, EIS and the R&D tax credit system, to ensure investors and firms have the best possible incentives for growth.

The panel invited submissions from a wide range of companies, financial institutions, academic bodies and investors. Inngot provided comments on the potential benefits of the UK’s supporting the availability of IP-based finance (where companies can use their IP as collateral for loans).

The report acknowledges concerns over the “limited debt funding options for growing companies. Historically lenders have relied on tangible asset security when lending to smaller companies. On top of the issues this can create… as the economic landscape shifts towards knowledge-led firms, it was pointed out that firms may have less in the way of tangible assets to secure loans. Roundtable participants pointed out that banks are highly reluctant to secure debt funding against IP.”

The report also said submissions “highlighted that alternate lenders to small and start-up businesses still struggled to access wholesale capital, and that improving this could in turn help drive SME lending growth.”

The review panel was headed by former Chief Economist of Goldman Sachs Lord Jim O’Neill, now a cross-bench peer and non-exec chairman of investment body Northern Gritstone. It also included tech entrepreneur Tom Adeyoola; Alex Depledge, CEO and co-founder of Resi.co.uk, the UK’s largest home improvement platform; and Julie Devonshire, the Director of the Entrepreneurship Institute at King’s College London.

Rachel Reeves, Shadow Chancellor, has revealed plans to shake-up funding for start-up and scale-up companies if the Labour Party wins the next General Election.

The proposals have been drawn up as part of the Start-up, Scale-up review of SME funding, tasked with delivering against Labour’s ambition to “make Britain the best place to start and grow a business.” The key recommendations of the review panel were announced to an audience of 350 business leaders at the Labour Party’s Business Conference on December 8th 2022.

Reeves said the recommendations are the first step in closing a £16bn investment gap for high-growth firms that the UK is missing out on, and they will be used to inform Labour’s next manifesto.

Martin Brassell, CEO of Inngot says: “We were delighted to see that the Start-up, Scale-up report has recognised the challenges faced by IP-rich but tangible asset-poor start-ups and scale-ups – as it says, banks have traditionally been reluctant to secure debt funding against IP. That attitude, however, is changing, and we are working with some of the more forward-thinking banks to help them assess IP value for lending purposes.”

The key recommendations of the review are:

Unlocking institutional investment and patient capital by: building engagement between institutional investors and VCs; freeing ISA investors to invest in high-growth firms; making pension fund investments more effective though fund consolidation; and allowing institutional investors to invest alongside the British Business Bank (BBB).

Transforming the British Business Bank: the BBB needs to be allowed more independence, given a wider remit and the ability to leverage external funds to amplify its work. The BBB should support the creation of clusters involving groups of universities to drive growth and investment across the whole of the UK.

Translating world-leading research into growth: Encourage entrepreneurialism and spinouts based on university research by creating a dashboard summarising each university’s offer to spinouts, and metrics of each university’s spinout success. The panel also recommended that universities offer a wider range of options for spinout founders to choose from, including one where the university takes a relatively small equity stake.

Making public procurement work for start-ups: Labour should create a Procurement Council of Experts to review best practice in public sector procurement, with a view to allowing start-ups to better compete for public contracts.

Incentivising investment and entrepreneurship: Labour should maintain and build on existing incentives, such as SEIS, EIS and the R&D tax credit system, to ensure investors and firms have the best possible incentives for growth.

The panel invited submissions from a wide range of companies, financial institutions, academic bodies and investors. Inngot provided comments on the potential benefits of the UK’s supporting the availability of IP-based finance (where companies can use their IP as collateral for loans).

The report acknowledges concerns over the “limited debt funding options for growing companies. Historically lenders have relied on tangible asset security when lending to smaller companies. On top of the issues this can create… as the economic landscape shifts towards knowledge-led firms, it was pointed out that firms may have less in the way of tangible assets to secure loans. Roundtable participants pointed out that banks are highly reluctant to secure debt funding against IP.”

The report also said submissions “highlighted that alternate lenders to small and start-up businesses still struggled to access wholesale capital, and that improving this could in turn help drive SME lending growth.”

The review panel was headed by former Chief Economist of Goldman Sachs Lord Jim O’Neill, now a cross-bench peer and non-exec chairman of investment body Northern Gritstone. It also included tech entrepreneur Tom Adeyoola; Alex Depledge, CEO and co-founder of Resi.co.uk, the UK’s largest home improvement platform; and Julie Devonshire, the Director of the Entrepreneurship Institute at King’s College London.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.