SMS marketing experts SixFive Networks secures £1 million loan from NatWest using its IP as collateral

4 Jun 2024

☑️ SixFive Networks has secured a seven figure Intellectual Property-backed loan from NatWest to support its business growth

☑️ The NatWest High Growth Intellectual Property-backed Loan is the world’s first ‘mass market’ loan for SME customers starting at just £250,000; this is the second loan to be offered under the new lending proposition

☑️ SixFive Networks offers a global cloud-based SMS gateway platform that provides businesses with high-quality, low-cost personalised text messaging solutions to connect with customers in more than 180 countries.

NatWest has extended a £1 million Intellectual Property-backed loan to global cloud-based SMS gateway platform provider SixFive Networks, to be used to help the company scale faster.

Christian Storseth, Six Five CEO, explained: “Our platform is powered by AWS and features cutting-edge AI-driven conditional routing technology that optimises message traffic to save time and money while still delivering a quality and efficient service.”

Its services are already being used by more than 500 companies globally on 1,200 mobile networks to deliver SMS marketing messages in 180 countries.

SixFive’s Chief Financial Officer, Haider Mawji, said that while SixFive Networks would have continued to grow without the NatWest loan, if the nine-year-old company had to rely on its resources, it would have meant scaling less quickly.

With the loan from NatWest, supported by using the company’s IP as collateral, Haider said: “it gives us confidence, because it validates the idea that investing in our IT is creating value for us. And now we can accelerate our growth, with NatWest’s support.”

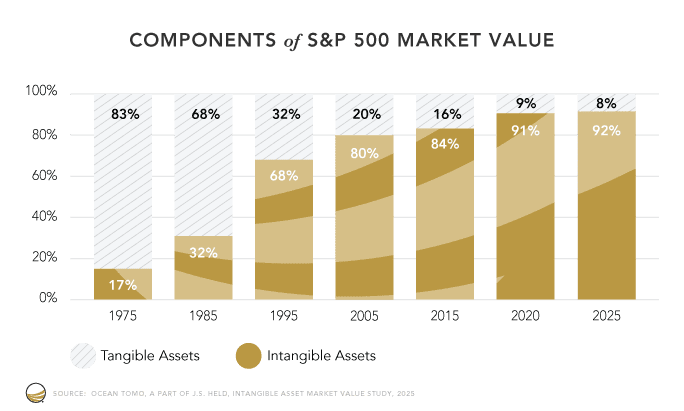

High growth businesses generally own few tangible assets, but can be rich in IP and intangible assets. These businesses can find it difficult to use their traditional assets as collateral to secure growth funding, leading to a potentially sizeable funding gap for fast-growing, but asset light, businesses.

NatWest’s High Growth IP Loan has been developed with specialist IP valuers Inngot to help unlock the funding gap for high growth firms. Loans start from amounts as low as £250,000 against up to 50% of the value of the firm’s intellectual property – software, patents, copyrights, trademarks and registered designs – as determined by Inngot’s tailored systems and processes.

Neil Bellamy, Head of Technology, Media and Telecoms at NatWest Group, said:

“Unlocking the power of intellectual property and intangible assets could really power up the UK economy. In the past, high-growth, scalable businesses which are almost always IP-rich but light on tangible assets have typically found debt financing challenging to access, leaving them with two options: grow organically, or dilute equity. With this new loan, borrowing is becoming a realistic option for businesses offering products and services that are backed by good IP.”

Mark Renard, the NatWest Relationship Director who worked with SixFive Networks to help them through the bank’s application process, said: “It’s fantastic that I have been able to support my client with material funding to aid their growth aspirations. Using the expertise in Inngot’s sophisticated tools, NatWest have successfully been able to leverage the value in Six Five’s underlying IP to structure an appropriate term debt solution.”

Martin Brassell, Chief Executive of Inngot, said: “NatWest’s High Growth IP loan marks the first time we have seen a UK bank willing to attribute collateral value directly to IP assets, at repayment levels that are highly affordable. The £250,000 starting point makes IP-based funding accessible to growth companies at real scale – and the fact that SixFive managed to get a seven figure loan based on the value of its IP shows how NatWest’s new lending proposition rewards UK SMEs for investing in IP; and I believe it will help more companies to realise the importance and value of a strong IP strategy. I can’t think of a better way to encourage SMEs to take IP more seriously than to show them that they can borrow against its value.”

Contact

For media queries, please contact Lucy Chislett, Media Relations Manager at lucy.chislett@natwest.com

About NatWest Group

NatWest Group is a relationship bank for a digital world. We champion potential; breaking down barriers and building financial confidence so the 19 million people, families and businesses we serve in communities throughout the UK and Ireland can rebuild and thrive. If our customers succeed, so will we.

About Inngot

Inngot has been providing IP valuation tools and services since 2010, with a particular focus on helping companies establish the value of their IP and intangible assets to support equity and debt fundraising. Its online platform, developed with SMEs in mind, offers a consistent, cost-effective and scalable way to identify and value these otherwise ‘hidden’ company-owned intangibles. The toolkit has been used by hundreds of early-stage and scale up

☑️ SixFive Networks has secured a seven figure Intellectual Property-backed loan from NatWest to support its business growth

☑️ The NatWest High Growth Intellectual Property-backed Loan is the world’s first ‘mass market’ loan for SME customers starting at just £250,000; this is the second loan to be offered under the new lending proposition

☑️ SixFive Networks offers a global cloud-based SMS gateway platform that provides businesses with high-quality, low-cost personalised text messaging solutions to connect with customers in more than 180 countries.

NatWest has extended a £1 million Intellectual Property-backed loan to global cloud-based SMS gateway platform provider SixFive Networks, to be used to help the company scale faster.

Christian Storseth, Six Five CEO, explained: “Our platform is powered by AWS and features cutting-edge AI-driven conditional routing technology that optimises message traffic to save time and money while still delivering a quality and efficient service.”

Its services are already being used by more than 500 companies globally on 1,200 mobile networks to deliver SMS marketing messages in 180 countries.

SixFive’s Chief Financial Officer, Haider Mawji, said that while SixFive Networks would have continued to grow without the NatWest loan, if the nine-year-old company had to rely on its resources, it would have meant scaling less quickly.

With the loan from NatWest, supported by using the company’s IP as collateral, Haider said: “it gives us confidence, because it validates the idea that investing in our IT is creating value for us. And now we can accelerate our growth, with NatWest’s support.”

High growth businesses generally own few tangible assets, but can be rich in IP and intangible assets. These businesses can find it difficult to use their traditional assets as collateral to secure growth funding, leading to a potentially sizeable funding gap for fast-growing, but asset light, businesses.

NatWest’s High Growth IP Loan has been developed with specialist IP valuers Inngot to help unlock the funding gap for high growth firms. Loans start from amounts as low as £250,000 against up to 50% of the value of the firm’s intellectual property – software, patents, copyrights, trademarks and registered designs – as determined by Inngot’s tailored systems and processes.

Neil Bellamy, Head of Technology, Media and Telecoms at NatWest Group, said:

“Unlocking the power of intellectual property and intangible assets could really power up the UK economy. In the past, high-growth, scalable businesses which are almost always IP-rich but light on tangible assets have typically found debt financing challenging to access, leaving them with two options: grow organically, or dilute equity. With this new loan, borrowing is becoming a realistic option for businesses offering products and services that are backed by good IP.”

Mark Renard, the NatWest Relationship Director who worked with SixFive Networks to help them through the bank’s application process, said: “It’s fantastic that I have been able to support my client with material funding to aid their growth aspirations. Using the expertise in Inngot’s sophisticated tools, NatWest have successfully been able to leverage the value in Six Five’s underlying IP to structure an appropriate term debt solution.”

Martin Brassell, Chief Executive of Inngot, said: “NatWest’s High Growth IP loan marks the first time we have seen a UK bank willing to attribute collateral value directly to IP assets, at repayment levels that are highly affordable. The £250,000 starting point makes IP-based funding accessible to growth companies at real scale – and the fact that SixFive managed to get a seven figure loan based on the value of its IP shows how NatWest’s new lending proposition rewards UK SMEs for investing in IP; and I believe it will help more companies to realise the importance and value of a strong IP strategy. I can’t think of a better way to encourage SMEs to take IP more seriously than to show them that they can borrow against its value.”

Contact

For media queries, please contact Lucy Chislett, Media Relations Manager at lucy.chislett@natwest.com

About NatWest Group

NatWest Group is a relationship bank for a digital world. We champion potential; breaking down barriers and building financial confidence so the 19 million people, families and businesses we serve in communities throughout the UK and Ireland can rebuild and thrive. If our customers succeed, so will we.

About Inngot

Inngot has been providing IP valuation tools and services since 2010, with a particular focus on helping companies establish the value of their IP and intangible assets to support equity and debt fundraising. Its online platform, developed with SMEs in mind, offers a consistent, cost-effective and scalable way to identify and value these otherwise ‘hidden’ company-owned intangibles. The toolkit has been used by hundreds of early-stage and scale up

☑️ SixFive Networks has secured a seven figure Intellectual Property-backed loan from NatWest to support its business growth

☑️ The NatWest High Growth Intellectual Property-backed Loan is the world’s first ‘mass market’ loan for SME customers starting at just £250,000; this is the second loan to be offered under the new lending proposition

☑️ SixFive Networks offers a global cloud-based SMS gateway platform that provides businesses with high-quality, low-cost personalised text messaging solutions to connect with customers in more than 180 countries.

NatWest has extended a £1 million Intellectual Property-backed loan to global cloud-based SMS gateway platform provider SixFive Networks, to be used to help the company scale faster.

Christian Storseth, Six Five CEO, explained: “Our platform is powered by AWS and features cutting-edge AI-driven conditional routing technology that optimises message traffic to save time and money while still delivering a quality and efficient service.”

Its services are already being used by more than 500 companies globally on 1,200 mobile networks to deliver SMS marketing messages in 180 countries.

SixFive’s Chief Financial Officer, Haider Mawji, said that while SixFive Networks would have continued to grow without the NatWest loan, if the nine-year-old company had to rely on its resources, it would have meant scaling less quickly.

With the loan from NatWest, supported by using the company’s IP as collateral, Haider said: “it gives us confidence, because it validates the idea that investing in our IT is creating value for us. And now we can accelerate our growth, with NatWest’s support.”

High growth businesses generally own few tangible assets, but can be rich in IP and intangible assets. These businesses can find it difficult to use their traditional assets as collateral to secure growth funding, leading to a potentially sizeable funding gap for fast-growing, but asset light, businesses.

NatWest’s High Growth IP Loan has been developed with specialist IP valuers Inngot to help unlock the funding gap for high growth firms. Loans start from amounts as low as £250,000 against up to 50% of the value of the firm’s intellectual property – software, patents, copyrights, trademarks and registered designs – as determined by Inngot’s tailored systems and processes.

Neil Bellamy, Head of Technology, Media and Telecoms at NatWest Group, said:

“Unlocking the power of intellectual property and intangible assets could really power up the UK economy. In the past, high-growth, scalable businesses which are almost always IP-rich but light on tangible assets have typically found debt financing challenging to access, leaving them with two options: grow organically, or dilute equity. With this new loan, borrowing is becoming a realistic option for businesses offering products and services that are backed by good IP.”

Mark Renard, the NatWest Relationship Director who worked with SixFive Networks to help them through the bank’s application process, said: “It’s fantastic that I have been able to support my client with material funding to aid their growth aspirations. Using the expertise in Inngot’s sophisticated tools, NatWest have successfully been able to leverage the value in Six Five’s underlying IP to structure an appropriate term debt solution.”

Martin Brassell, Chief Executive of Inngot, said: “NatWest’s High Growth IP loan marks the first time we have seen a UK bank willing to attribute collateral value directly to IP assets, at repayment levels that are highly affordable. The £250,000 starting point makes IP-based funding accessible to growth companies at real scale – and the fact that SixFive managed to get a seven figure loan based on the value of its IP shows how NatWest’s new lending proposition rewards UK SMEs for investing in IP; and I believe it will help more companies to realise the importance and value of a strong IP strategy. I can’t think of a better way to encourage SMEs to take IP more seriously than to show them that they can borrow against its value.”

Contact

For media queries, please contact Lucy Chislett, Media Relations Manager at lucy.chislett@natwest.com

About NatWest Group

NatWest Group is a relationship bank for a digital world. We champion potential; breaking down barriers and building financial confidence so the 19 million people, families and businesses we serve in communities throughout the UK and Ireland can rebuild and thrive. If our customers succeed, so will we.

About Inngot

Inngot has been providing IP valuation tools and services since 2010, with a particular focus on helping companies establish the value of their IP and intangible assets to support equity and debt fundraising. Its online platform, developed with SMEs in mind, offers a consistent, cost-effective and scalable way to identify and value these otherwise ‘hidden’ company-owned intangibles. The toolkit has been used by hundreds of early-stage and scale up

☑️ SixFive Networks has secured a seven figure Intellectual Property-backed loan from NatWest to support its business growth

☑️ The NatWest High Growth Intellectual Property-backed Loan is the world’s first ‘mass market’ loan for SME customers starting at just £250,000; this is the second loan to be offered under the new lending proposition

☑️ SixFive Networks offers a global cloud-based SMS gateway platform that provides businesses with high-quality, low-cost personalised text messaging solutions to connect with customers in more than 180 countries.

NatWest has extended a £1 million Intellectual Property-backed loan to global cloud-based SMS gateway platform provider SixFive Networks, to be used to help the company scale faster.

Christian Storseth, Six Five CEO, explained: “Our platform is powered by AWS and features cutting-edge AI-driven conditional routing technology that optimises message traffic to save time and money while still delivering a quality and efficient service.”

Its services are already being used by more than 500 companies globally on 1,200 mobile networks to deliver SMS marketing messages in 180 countries.

SixFive’s Chief Financial Officer, Haider Mawji, said that while SixFive Networks would have continued to grow without the NatWest loan, if the nine-year-old company had to rely on its resources, it would have meant scaling less quickly.

With the loan from NatWest, supported by using the company’s IP as collateral, Haider said: “it gives us confidence, because it validates the idea that investing in our IT is creating value for us. And now we can accelerate our growth, with NatWest’s support.”

High growth businesses generally own few tangible assets, but can be rich in IP and intangible assets. These businesses can find it difficult to use their traditional assets as collateral to secure growth funding, leading to a potentially sizeable funding gap for fast-growing, but asset light, businesses.

NatWest’s High Growth IP Loan has been developed with specialist IP valuers Inngot to help unlock the funding gap for high growth firms. Loans start from amounts as low as £250,000 against up to 50% of the value of the firm’s intellectual property – software, patents, copyrights, trademarks and registered designs – as determined by Inngot’s tailored systems and processes.

Neil Bellamy, Head of Technology, Media and Telecoms at NatWest Group, said:

“Unlocking the power of intellectual property and intangible assets could really power up the UK economy. In the past, high-growth, scalable businesses which are almost always IP-rich but light on tangible assets have typically found debt financing challenging to access, leaving them with two options: grow organically, or dilute equity. With this new loan, borrowing is becoming a realistic option for businesses offering products and services that are backed by good IP.”

Mark Renard, the NatWest Relationship Director who worked with SixFive Networks to help them through the bank’s application process, said: “It’s fantastic that I have been able to support my client with material funding to aid their growth aspirations. Using the expertise in Inngot’s sophisticated tools, NatWest have successfully been able to leverage the value in Six Five’s underlying IP to structure an appropriate term debt solution.”

Martin Brassell, Chief Executive of Inngot, said: “NatWest’s High Growth IP loan marks the first time we have seen a UK bank willing to attribute collateral value directly to IP assets, at repayment levels that are highly affordable. The £250,000 starting point makes IP-based funding accessible to growth companies at real scale – and the fact that SixFive managed to get a seven figure loan based on the value of its IP shows how NatWest’s new lending proposition rewards UK SMEs for investing in IP; and I believe it will help more companies to realise the importance and value of a strong IP strategy. I can’t think of a better way to encourage SMEs to take IP more seriously than to show them that they can borrow against its value.”

Contact

For media queries, please contact Lucy Chislett, Media Relations Manager at lucy.chislett@natwest.com

About NatWest Group

NatWest Group is a relationship bank for a digital world. We champion potential; breaking down barriers and building financial confidence so the 19 million people, families and businesses we serve in communities throughout the UK and Ireland can rebuild and thrive. If our customers succeed, so will we.

About Inngot

Inngot has been providing IP valuation tools and services since 2010, with a particular focus on helping companies establish the value of their IP and intangible assets to support equity and debt fundraising. Its online platform, developed with SMEs in mind, offers a consistent, cost-effective and scalable way to identify and value these otherwise ‘hidden’ company-owned intangibles. The toolkit has been used by hundreds of early-stage and scale up

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.