Sci-Net, first company to benefit from NatWest’s revolutionary IP-backed loan, is acquired

20 Oct 2025

The purchaser is digital transformation specialist ANS, which has bought Oxford-based Microsoft business solutions partner Sci-Net Business Solutions, known for its ERP, CRM and cloud infrastructure expertise, for an undisclosed sum. Multiple IT media sites have covered the story, including BusinessCloud.

The deal, supported financially by Inflexion and Barings, adds Sci-Net’s 65 consultants to Manchester-based ANS’ existing 750-strong workforce and expands the company’s capacity to deliver Microsoft-based digital infrastructure upgrades across sectors including retail, e-commerce, and wholesale and distribution.

Oxfordshire-headquartered Sci-Net, which has been operating for 25 years, is recognised for its implementation of Microsoft Dynamics NAV, 365 Business Central, CRM and Microsoft Azure solutions.

ANS also works closely with Microsoft, and was named Microsoft Services Partner of the Year 2024. In the last couple of years, ANS has been expanding its expertise and offerings across cloud, data and AI transformation through acquisition. It bought purchase of data engineering consultancy Makutu in September 2025 and Dynamics 365 specialist Preact in 2022.

The latest news comes 18 months after Sci-Net successfully negotiated a £700,000 loan from NatWest, which had launched its new IP-backed growth funding proposition in January 2024.

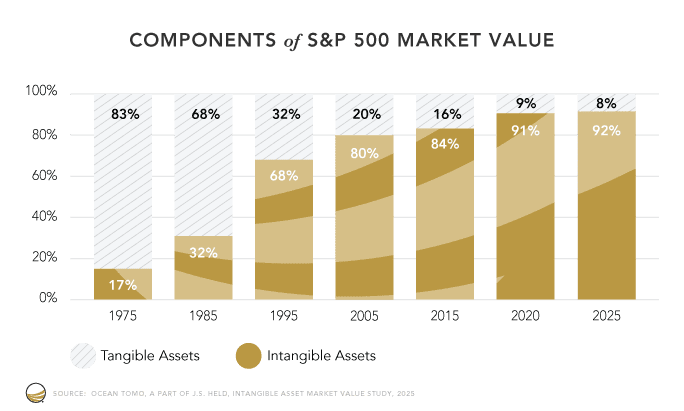

The NatWest IP loan targets growth companies which have few tangible assets to use as collateral but are rich in IP and intangibles which actually drive their business. It was developed by the bank in partnership with IP valuation and commercialisation experts Inngot, and the latter’s online tools are an integral part of the loan assessment process, allowing NatWest to make its decisions quickly, accurately and at a cost which is competitive compared with other loans on the market.

The Times covered the news in April last year, and quoted Sci-Net founder and managing director Duncan Fergusson as saying: “Traditional loans are limited as to how much they will lend unless you have a physical asset like a building. Whereas with IP loans there is an asset, albeit a virtual one, and you can get better rates and it’s more flexible.” The Times story can be read here (subscription required).

In The Times article, NatWest’s Head of Technology, Media and Telecoms, Neil Bellamy, said: “With this loan, we have shown the potential that unlocking value from IP and intangible assets could have for the UK economy.”

Duncan Fergusson added that the £700,000 loan would enable it to accelerate its software development. He also explained that he switched to NatWest from his previous bank in order to take advantage of the new IP-backed loan.

NatWest asks companies applying for the IP finance loans to use Inngot’s online tools, which identify the IP and intangibles driving company performance, value them, and also assess their suitability to be used as security for lending. The cost for this valuation and collateral checking tools is under £1,000.

Once the loan is drawn down, the customer also pays a one-off upfront monitoring fee to cover due diligence checks on the value of the IP over the lifetime of the loan, plus separate charges for annual revaluations. All charges are clearly set out in the NatWest terms and conditions.

Inngot’s online tools have been developed and refined over the past 10 years to give SMEs a cost-effective, fast and independent valuation for core IP and intangible assets, which they can use for a range of purposes – informing discussions with lenders and investors, tax issues, grant applications, estate matters, spin outs and more.

In addition to NatWest, HSBC also uses Inngot’s IP toolkit to help it make lending decisions for its High Growth loan portfolio. A number of other UK and overseas banks are also in discussions with Inngot over integrating its tools into their services.

A case study on the Sci-Net loan can be downloaded from the Inngot website.

The purchaser is digital transformation specialist ANS, which has bought Oxford-based Microsoft business solutions partner Sci-Net Business Solutions, known for its ERP, CRM and cloud infrastructure expertise, for an undisclosed sum. Multiple IT media sites have covered the story, including BusinessCloud.

The deal, supported financially by Inflexion and Barings, adds Sci-Net’s 65 consultants to Manchester-based ANS’ existing 750-strong workforce and expands the company’s capacity to deliver Microsoft-based digital infrastructure upgrades across sectors including retail, e-commerce, and wholesale and distribution.

Oxfordshire-headquartered Sci-Net, which has been operating for 25 years, is recognised for its implementation of Microsoft Dynamics NAV, 365 Business Central, CRM and Microsoft Azure solutions.

ANS also works closely with Microsoft, and was named Microsoft Services Partner of the Year 2024. In the last couple of years, ANS has been expanding its expertise and offerings across cloud, data and AI transformation through acquisition. It bought purchase of data engineering consultancy Makutu in September 2025 and Dynamics 365 specialist Preact in 2022.

The latest news comes 18 months after Sci-Net successfully negotiated a £700,000 loan from NatWest, which had launched its new IP-backed growth funding proposition in January 2024.

The NatWest IP loan targets growth companies which have few tangible assets to use as collateral but are rich in IP and intangibles which actually drive their business. It was developed by the bank in partnership with IP valuation and commercialisation experts Inngot, and the latter’s online tools are an integral part of the loan assessment process, allowing NatWest to make its decisions quickly, accurately and at a cost which is competitive compared with other loans on the market.

The Times covered the news in April last year, and quoted Sci-Net founder and managing director Duncan Fergusson as saying: “Traditional loans are limited as to how much they will lend unless you have a physical asset like a building. Whereas with IP loans there is an asset, albeit a virtual one, and you can get better rates and it’s more flexible.” The Times story can be read here (subscription required).

In The Times article, NatWest’s Head of Technology, Media and Telecoms, Neil Bellamy, said: “With this loan, we have shown the potential that unlocking value from IP and intangible assets could have for the UK economy.”

Duncan Fergusson added that the £700,000 loan would enable it to accelerate its software development. He also explained that he switched to NatWest from his previous bank in order to take advantage of the new IP-backed loan.

NatWest asks companies applying for the IP finance loans to use Inngot’s online tools, which identify the IP and intangibles driving company performance, value them, and also assess their suitability to be used as security for lending. The cost for this valuation and collateral checking tools is under £1,000.

Once the loan is drawn down, the customer also pays a one-off upfront monitoring fee to cover due diligence checks on the value of the IP over the lifetime of the loan, plus separate charges for annual revaluations. All charges are clearly set out in the NatWest terms and conditions.

Inngot’s online tools have been developed and refined over the past 10 years to give SMEs a cost-effective, fast and independent valuation for core IP and intangible assets, which they can use for a range of purposes – informing discussions with lenders and investors, tax issues, grant applications, estate matters, spin outs and more.

In addition to NatWest, HSBC also uses Inngot’s IP toolkit to help it make lending decisions for its High Growth loan portfolio. A number of other UK and overseas banks are also in discussions with Inngot over integrating its tools into their services.

A case study on the Sci-Net loan can be downloaded from the Inngot website.

The purchaser is digital transformation specialist ANS, which has bought Oxford-based Microsoft business solutions partner Sci-Net Business Solutions, known for its ERP, CRM and cloud infrastructure expertise, for an undisclosed sum. Multiple IT media sites have covered the story, including BusinessCloud.

The deal, supported financially by Inflexion and Barings, adds Sci-Net’s 65 consultants to Manchester-based ANS’ existing 750-strong workforce and expands the company’s capacity to deliver Microsoft-based digital infrastructure upgrades across sectors including retail, e-commerce, and wholesale and distribution.

Oxfordshire-headquartered Sci-Net, which has been operating for 25 years, is recognised for its implementation of Microsoft Dynamics NAV, 365 Business Central, CRM and Microsoft Azure solutions.

ANS also works closely with Microsoft, and was named Microsoft Services Partner of the Year 2024. In the last couple of years, ANS has been expanding its expertise and offerings across cloud, data and AI transformation through acquisition. It bought purchase of data engineering consultancy Makutu in September 2025 and Dynamics 365 specialist Preact in 2022.

The latest news comes 18 months after Sci-Net successfully negotiated a £700,000 loan from NatWest, which had launched its new IP-backed growth funding proposition in January 2024.

The NatWest IP loan targets growth companies which have few tangible assets to use as collateral but are rich in IP and intangibles which actually drive their business. It was developed by the bank in partnership with IP valuation and commercialisation experts Inngot, and the latter’s online tools are an integral part of the loan assessment process, allowing NatWest to make its decisions quickly, accurately and at a cost which is competitive compared with other loans on the market.

The Times covered the news in April last year, and quoted Sci-Net founder and managing director Duncan Fergusson as saying: “Traditional loans are limited as to how much they will lend unless you have a physical asset like a building. Whereas with IP loans there is an asset, albeit a virtual one, and you can get better rates and it’s more flexible.” The Times story can be read here (subscription required).

In The Times article, NatWest’s Head of Technology, Media and Telecoms, Neil Bellamy, said: “With this loan, we have shown the potential that unlocking value from IP and intangible assets could have for the UK economy.”

Duncan Fergusson added that the £700,000 loan would enable it to accelerate its software development. He also explained that he switched to NatWest from his previous bank in order to take advantage of the new IP-backed loan.

NatWest asks companies applying for the IP finance loans to use Inngot’s online tools, which identify the IP and intangibles driving company performance, value them, and also assess their suitability to be used as security for lending. The cost for this valuation and collateral checking tools is under £1,000.

Once the loan is drawn down, the customer also pays a one-off upfront monitoring fee to cover due diligence checks on the value of the IP over the lifetime of the loan, plus separate charges for annual revaluations. All charges are clearly set out in the NatWest terms and conditions.

Inngot’s online tools have been developed and refined over the past 10 years to give SMEs a cost-effective, fast and independent valuation for core IP and intangible assets, which they can use for a range of purposes – informing discussions with lenders and investors, tax issues, grant applications, estate matters, spin outs and more.

In addition to NatWest, HSBC also uses Inngot’s IP toolkit to help it make lending decisions for its High Growth loan portfolio. A number of other UK and overseas banks are also in discussions with Inngot over integrating its tools into their services.

A case study on the Sci-Net loan can be downloaded from the Inngot website.

The purchaser is digital transformation specialist ANS, which has bought Oxford-based Microsoft business solutions partner Sci-Net Business Solutions, known for its ERP, CRM and cloud infrastructure expertise, for an undisclosed sum. Multiple IT media sites have covered the story, including BusinessCloud.

The deal, supported financially by Inflexion and Barings, adds Sci-Net’s 65 consultants to Manchester-based ANS’ existing 750-strong workforce and expands the company’s capacity to deliver Microsoft-based digital infrastructure upgrades across sectors including retail, e-commerce, and wholesale and distribution.

Oxfordshire-headquartered Sci-Net, which has been operating for 25 years, is recognised for its implementation of Microsoft Dynamics NAV, 365 Business Central, CRM and Microsoft Azure solutions.

ANS also works closely with Microsoft, and was named Microsoft Services Partner of the Year 2024. In the last couple of years, ANS has been expanding its expertise and offerings across cloud, data and AI transformation through acquisition. It bought purchase of data engineering consultancy Makutu in September 2025 and Dynamics 365 specialist Preact in 2022.

The latest news comes 18 months after Sci-Net successfully negotiated a £700,000 loan from NatWest, which had launched its new IP-backed growth funding proposition in January 2024.

The NatWest IP loan targets growth companies which have few tangible assets to use as collateral but are rich in IP and intangibles which actually drive their business. It was developed by the bank in partnership with IP valuation and commercialisation experts Inngot, and the latter’s online tools are an integral part of the loan assessment process, allowing NatWest to make its decisions quickly, accurately and at a cost which is competitive compared with other loans on the market.

The Times covered the news in April last year, and quoted Sci-Net founder and managing director Duncan Fergusson as saying: “Traditional loans are limited as to how much they will lend unless you have a physical asset like a building. Whereas with IP loans there is an asset, albeit a virtual one, and you can get better rates and it’s more flexible.” The Times story can be read here (subscription required).

In The Times article, NatWest’s Head of Technology, Media and Telecoms, Neil Bellamy, said: “With this loan, we have shown the potential that unlocking value from IP and intangible assets could have for the UK economy.”

Duncan Fergusson added that the £700,000 loan would enable it to accelerate its software development. He also explained that he switched to NatWest from his previous bank in order to take advantage of the new IP-backed loan.

NatWest asks companies applying for the IP finance loans to use Inngot’s online tools, which identify the IP and intangibles driving company performance, value them, and also assess their suitability to be used as security for lending. The cost for this valuation and collateral checking tools is under £1,000.

Once the loan is drawn down, the customer also pays a one-off upfront monitoring fee to cover due diligence checks on the value of the IP over the lifetime of the loan, plus separate charges for annual revaluations. All charges are clearly set out in the NatWest terms and conditions.

Inngot’s online tools have been developed and refined over the past 10 years to give SMEs a cost-effective, fast and independent valuation for core IP and intangible assets, which they can use for a range of purposes – informing discussions with lenders and investors, tax issues, grant applications, estate matters, spin outs and more.

In addition to NatWest, HSBC also uses Inngot’s IP toolkit to help it make lending decisions for its High Growth loan portfolio. A number of other UK and overseas banks are also in discussions with Inngot over integrating its tools into their services.

A case study on the Sci-Net loan can be downloaded from the Inngot website.

Read Recent Articles

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.

Inngot's online platform identifies all your intangible assets and demonstrates their value to lenders, investors, acquirers, licensees and stakeholders

Accreditations

Copyright © Inngot Limited 2019-2025. All rights reserved.